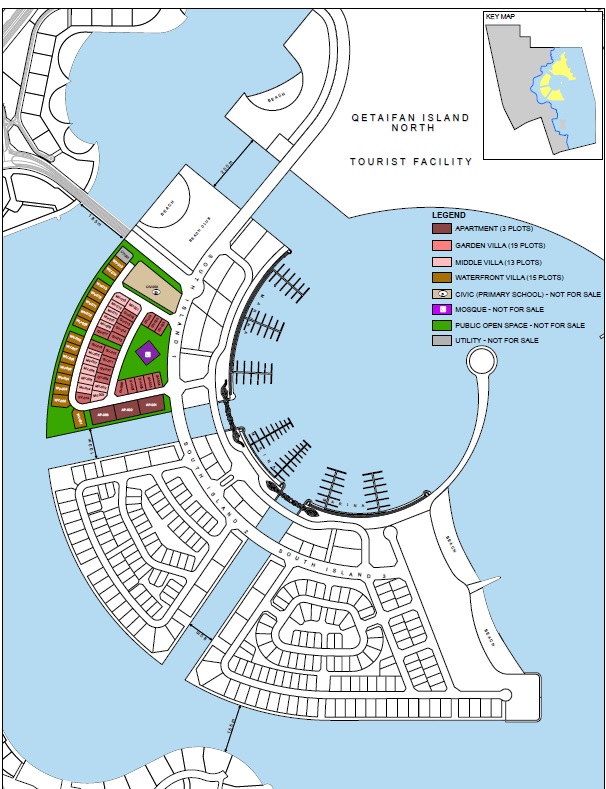

Plots And Plan

Dec 09, 2018 Plot plans provide valuable information, including the physical boundaries of the parcel and the locations of structures, fences and driveways. Buy this erf comprising 704 sqm and build your dream home.This plot is situated in a quiet cul-de-sac close to all major routes, in the sought after area of Haasendal.It is fully serviced and approved plans.

Icon of the game Codycross © Fanatee, Inc.

We have solved this clue..

Just below the answer, you will be guided to the complete puzzle.

Striving for the right answers? Lucky You! You are in the right place and time to meet your ambition. In fact, this topic is meant to untwist the answers of CodyCross Plot and plan. Accordingly, we provide you with all hints and cheats and needed answers to accomplish the required crossword and find a final word of the puzzle group.

CodyCross Plot and plan Answers:

PS: Check out this topic below if you are seeking to solve another level answers :

- The cost of the Mortgage Inspection Plot Plan is $175.00, and the cost of an instrument survey would vary based upon the propertybut an estimate would be $2,000.00–$3,000.00 (and may require a few weeks to prepare, depending on the availability of the surveyor).

- Alexander says the plot-and-plan system is more complicated. Here, the builder’s operation, after they have funded the first month from their own resources, is financed by the buyer or, in most cases, the bank which has granted the bond. Payments are made when certain stipulated sections of the work are completed.

- SCHEME

We are pleased to help you find the word you searched for.

Hence, don’t you want to continue this great winning adventure?

You can either go back the Main Puzzle : CodyCross Group 17 Puzzle 3 or discover the answers of all the puzzle group here : Codycross Group 17.

Aubrey Woods Plums Plots And Plans

if you have any feedback or comments on this, please post it below.

Thank You.

Michael

What is a Plot Plan and why do I need it?

A Plot Plan, or more precisely named Mortgage Inspection Plan, is used by title insurance companies and mortgage lenders to answer the following questions:

Plots And Plans Kettering

- Does the house or building, as well as accessory structures (pools, sheds, etc), conform to the local setback zoning by-laws?

- Does the house or building, as well as accessory structures, fall within the F.E.M.A. flood hazard zone (which would require flood insurance)?

- Are there any building encroachments?

- Are there any easements that are associated with the property?

In addition to answering these questions, the Mortgage Inspection Plan indicates the reference information used in its preparation. These references include deed book and page numbers, property plan numbers, land court plan numbers (if applicable), assessor map and lot numbers and F.E.M.A. rate map numbers. This information can be very helpful to the homeowner.

Because the measurements are taken with tapes only, and not with electronic surveying instruments, the accuracy is usually within two to three feet. However, it must be remembered that the field work involved in preparing the Mortgage Inspection Plan does not include the setting of property line stakes. Therefore, although tape measurements are sufficient to make zoning and flood hazard determinations, the plan should not be used to determine exact property lines and is not a substitute for a full instrument survey.

How is the Mortgage Inspection Plan Performed?

- A physical inspection of the dwelling’s exterior is made, with tape measurements to show the approximate location of the dwelling

- Record documents are obtained at the Registry of Deeds or town offices to determine the lot configuration

- Information from the field is merged with record information to create a drawing of the property (the plot plan) and the approximate location of the dwelling on the lot

- Flood zone is determined

What is the Purpose of the Mortgage Inspection Plan?

The Mortgage Inspection Plan is a tool used to identify potential survey problems. Not to be confused with an instrument survey, the Mortgage Inspection Plan serves several very basic purposes:

- To satisfy part of a real estate closing

- Certifies compliance of the original dwelling with zoning set-back requirements at the time of construction

- Certifies as to the flood zone of the dwelling (for flood insurance purposes)

- May identify and note potential encroachments, boundary conflicts, violations or other on-the-ground problems worthy of further investigation

What is Not Provided by a Mortgage Plot Plan?

- No representation is made as to the accuracy of the depicted property lines

- No attempt has been made to verify the boundary configuration or, typically, the mathematical correctness of the description

- Property corners cannot be located based on this type of plan, therefore no fences, hedge rows or other improvements can be determined or located

- The location of any improvements shown are approximate, and therefore any planned construction should not be based on the locations as shown

What is a Certified Plot Plan or Instrument Survey?

An accurate survey involves the location of established monuments or survey control points, which are then mathematically tied in to the property being surveyed. This process utilizes sophisticated, state-of-the-art equipment, and precisely locates both the property lines and the improvements on the property in relation to those property lines.

Drawing A Plot Plan

Please Note:

In any circumstance where accuracy is required – example: for construction, location of fences, pools or other improvements – a full instrument survey is necessary. No changes or designs should be made to the property using a Mortgage Inspection Plot Plan – it is not an accurate survey and is not intended for these purposes.

What is the Cost?

Plot Drawing

The cost of the Mortgage Inspection Plot Plan is $175.00, and the cost of an instrument survey would vary based upon the property…but an estimate would be $2,000.00–$3,000.00 (and may require a few weeks to prepare, depending on the availability of the surveyor).